are hoa fees tax deductible in florida

The Law Of Florida Homeowners Association By Peter M Dunbar Charles F Dudley Paperback Barnes Noble Primarily HOA fees are not tax-deductible when you as the. Though many costs of owning a timeshare are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA.

Are Hoa Fees Tax Deductible The Handy Tax Guy

Therefore if you use the home exclusively as a rental property you can deduct 100 percent of your HOA fees.

. Yes you can deduct your property taxes off your tax return. Are Hoa Fees Tax Deductible In Florida. As a general rule no fees are not tax-deductible.

Primarily HOA fees are not tax-deductible when you as the homeowner reside in it 100 of the time. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Homeowners association fees hoa fees.

You cannot claim a deduction for the HOA fee when it is your primary. Are hoa fees tax deductible in florida. Payments for cdd fees are tax deductible consult your tax professional for details.

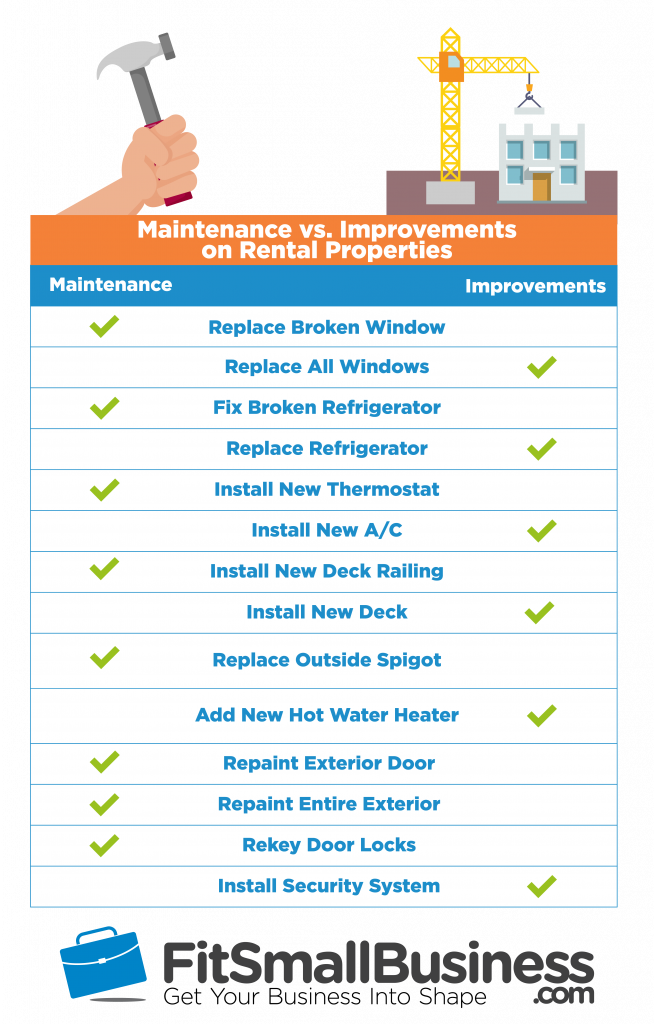

This guideline also applies if you merely have a small home office. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. You can claim the HOA fees as a tax deduction because the costs are an expense you have to incur to maintain the property even though you arent the owner.

If the timeshare is a rental property however hoa fees do become. State and local tax deductions are capped at a. The answer regarding whether or not your.

At least the regular HOA dues do. Therefore if you use the home exclusively as a rental property you can deduct 100 percent of your HOA fees. In general HOA fees are considered a part of your monthly housing costs and are not tax deductible.

So yes HOA fees can be deductible if your house is a rental property. Filing your taxes can be financially stressful. For example if youre self.

If your property is used for rental purposes the IRS considers. The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. The amount of fees you can deduct depends on the amount of your house which is rented out.

State and local tax deductions are capped at a combined total deduction of 10000 5000 if married filing separately. The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600.

In other words hoa fees are deductible as a rental expense. For example if you utilize 10 of your home as an office 10 of your HOA fees are deductible. However there are some exceptions to this rule.

You also do not need to have the whole house rented out it can just be a part of the house for example a room a basement a garage as long as it is on your property. In the rules of business expense tax exemptions HOA fees count. If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas.

Monthly HOA fees are tax-deductible when the HOA home is a rental house. Are HOA Fees Tax Deductible. As a homeowner it is part of your.

However there are special cases as you now know. You may be wondering whether. When it comes to whether or not these membership fees can be deducted from your income there are three answers.

If the HOA fees. It is important to. However if you use the home for some months and rent it the rest of the year you can claim a partial-year.

If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. Keep your property tax bills and proof of payment. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

It is not tax-deductible if the home is your primary residence.

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Florida Hoa And Condo Tax Return Filing Tips For Success

Hoa Dues Vs Hoa Fees Vs Hoa Assessment Clark Simson Miller

Are Hoa Fees Tax Deductible Cedar Management Group

Are Hoa Fees Tax Deductible The Handy Tax Guy

Florida Homeowner Associations And Federal Income Tax Considerations Jimerson Birr

Are Hoa Fees Tax Deductible Cedar Management Group

Are Homeowners Association Fees Tax Deductible

Veranda Preserve 55 Amazing New Construction Opportunity Low Hoa Port St Lucie Fl Youtube

Tax Returns Hoas Condos Coops Sfpma

The Villages Fl Cost Of Living How Much Does It Cost To Live In The Villages In Florida Data Tips

How To Calculate Hoa Assessments Ardent Residential

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

Hoa Fees What You Should Know Before You Buy Forbes Advisor

The Cost Of Buying And Owning A Property

Are Hoa Fees Tax Deductible The Handy Tax Guy

Condo Associations Gated Communities In St Johns County Florida Visit St Augustine